PhD student in Saw Swee Hock School of Public Health

Organizing chair of Robotics Innovation Challenge (RIC)

National University of Singapore (NUS)

Specialized in Healthcare data analytics with AI

Supervised by Prof. Feng Mengling

My Email: ephwha at nus.edu.sg / wh1996fz at live.com

My journey of stock investment so far - Part 1

10 Feb 2021 - Investment

On the night before the Chinese New Year eve, I would like to look back and do a summary on my journey of stock investment. This is to remind myself of the rights and wrongs along the journey, and to share with my audience some tips in investment.

Disclaimer: This article is not intended as, and shall not be understood or construed as, any financial advice.

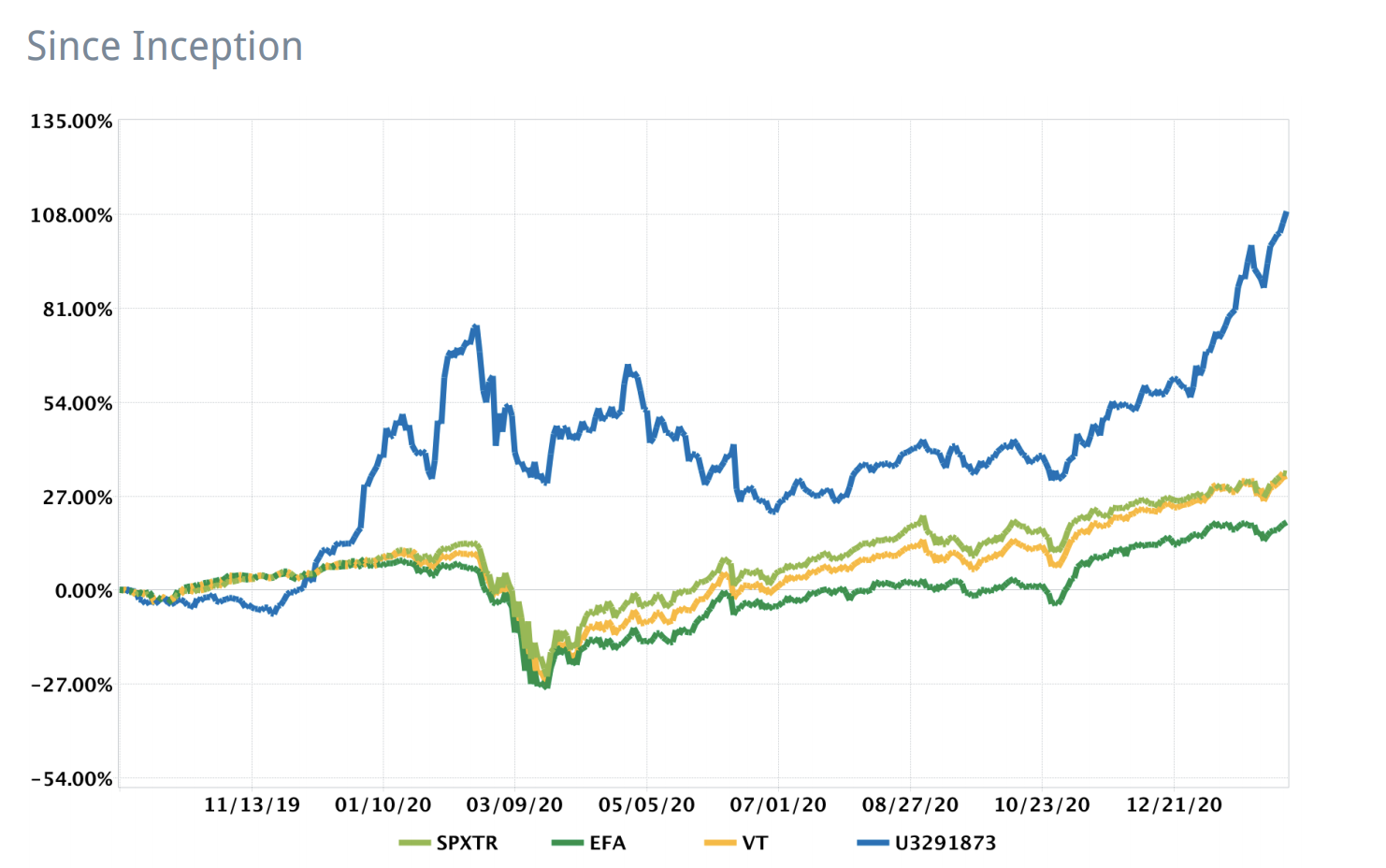

Results: ~100% Money Weighted Return (MWR) over 1 year and 3 months.

I would like to divide my journey into 4 periods:

- The luck (Nov 19 ~ Feb 20) : I made some lucky money on stocks without much logic

- The crush (Mar 20 ~ Apr 20): Market crushed and I was scared and let go of my stocks

- The misbelief (May 20 ~ Oct 20): Over-confident in a small cap stock that ruined all my gains

- The learning (Nov 20 ~ now): Learning basic valuation and build up my investment logic

The luck

When I just started investing, I was a complete newbie. I bought stocks based on trends, based on news, based on my own beliefs, based on anything but valuation of the company.

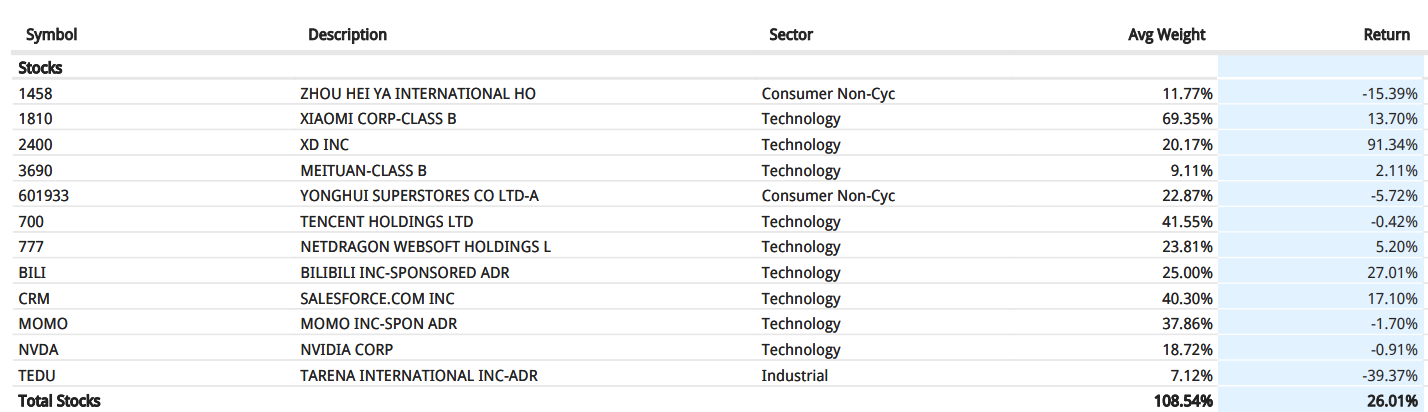

Luckily, some of the companies I bought (e.g. 2400.HK, BILI and CRM) performed well and gave me the initial confidence in continuing stock investing. However, one bomb was planted in my porfolio and exploded later.

2400.HK: I bought it when it was just listed in HK market. I knew TapTap as a platform some time ago, but I didn’t play any of their games before. I liked the gaming industry and believed the CEO was just and capable. The stock price started to rise immediately, and after it peaked and dipped, I sold it with around 100% of profit. If I didn’t sell it, it would make me more than 500% instead today. In the next few months, I bought it back a few times, but sold it based on price trend again.

-

I would never be able to “eat most part of the fish” if I don’t understand the value of the company.

-

The buy logic and sell logic was completely different, and I hope I don’t make the same mistake again.

1458.HK: I heard their product so many times but I was not able to try it myself once. I already forgot why I bought it, probably hearing the news that they are opening up the franchise and authorizing to local agents. Once I bought it, the stock price starts to decrease and I saw so many articles talking about how JueWei and HuangShangHuang is beating its ass off. I sold it after it hit my stop loss around 15%. The stock price is almost double after 1 year now.

- It requires understanding of a company to hold it when the price goes down. I used to have stop loss with a stock that I didn’t buy based on trend. It just meant when I bought the stock, I was betting it will rocket before it dropped 15%.

At the end of this period, I didn’t realize the problem in my investment yet. I was quite happy with myself, and started to buy stocks over margins. I also have no sense of risk management. And these all led to the first crisis in my investment journey.